LETTERS OF VERIFICATION

This material references Disclosure 102-56 of GRI 102: General Disclosures 2016

Opinion

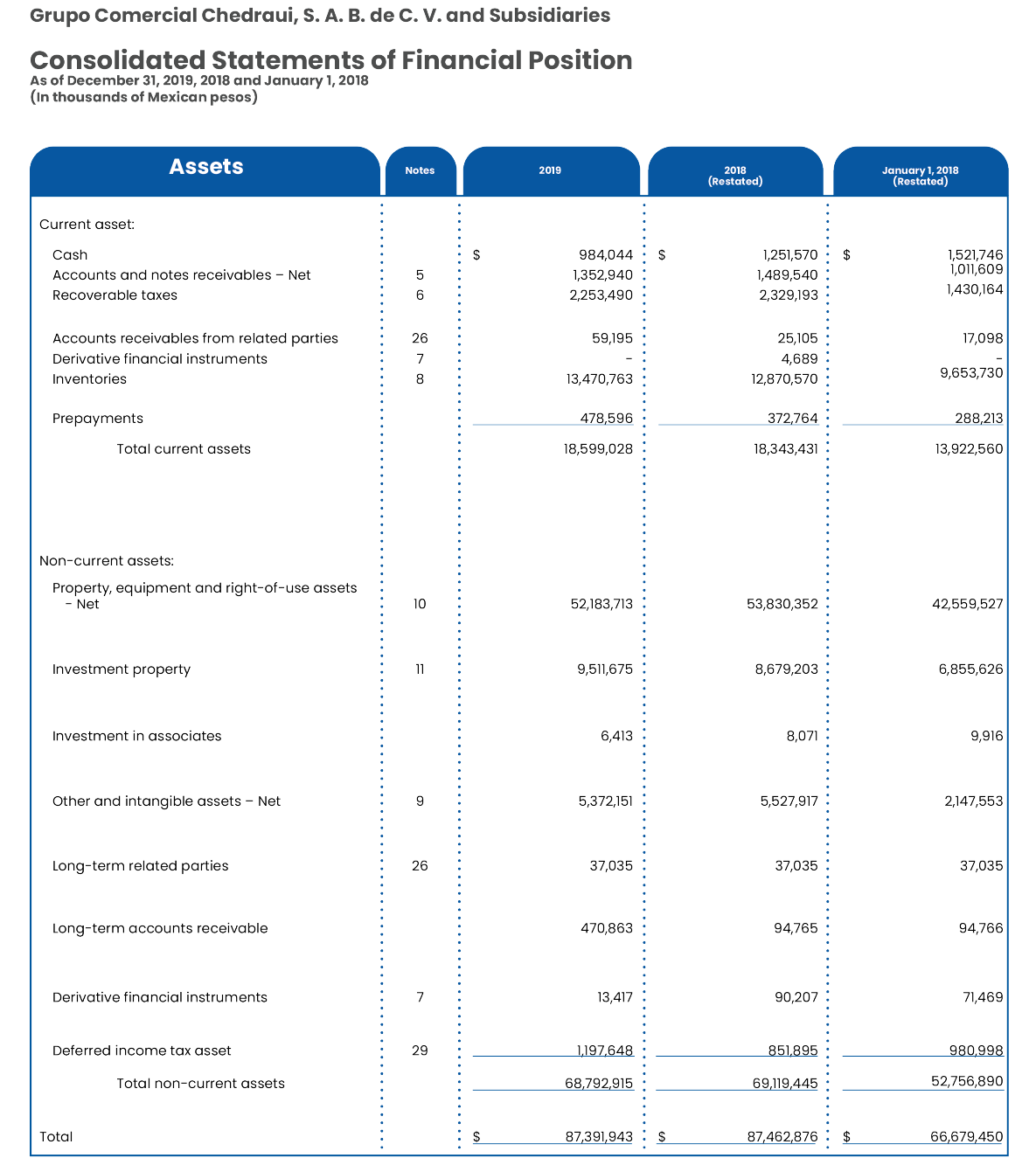

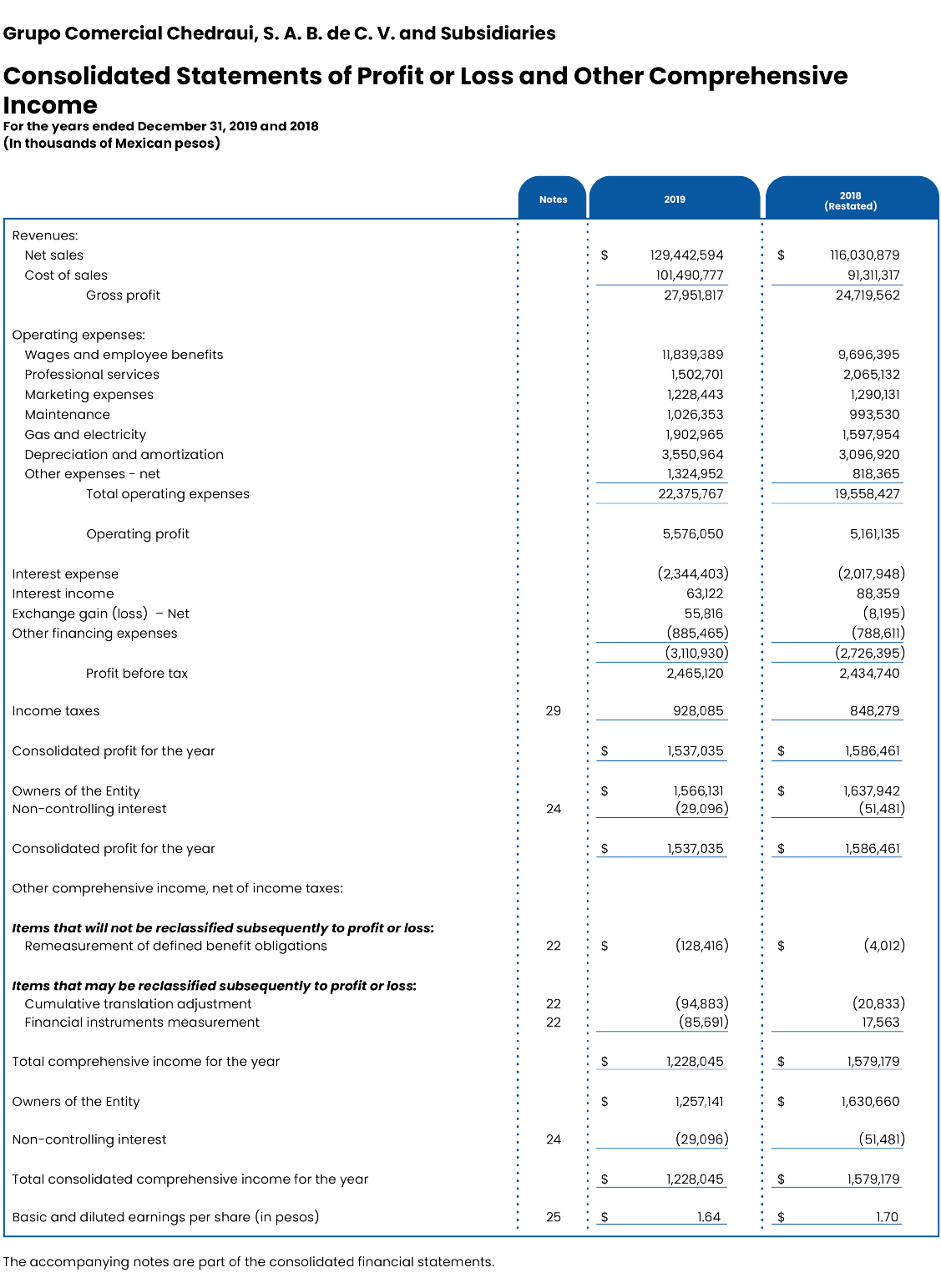

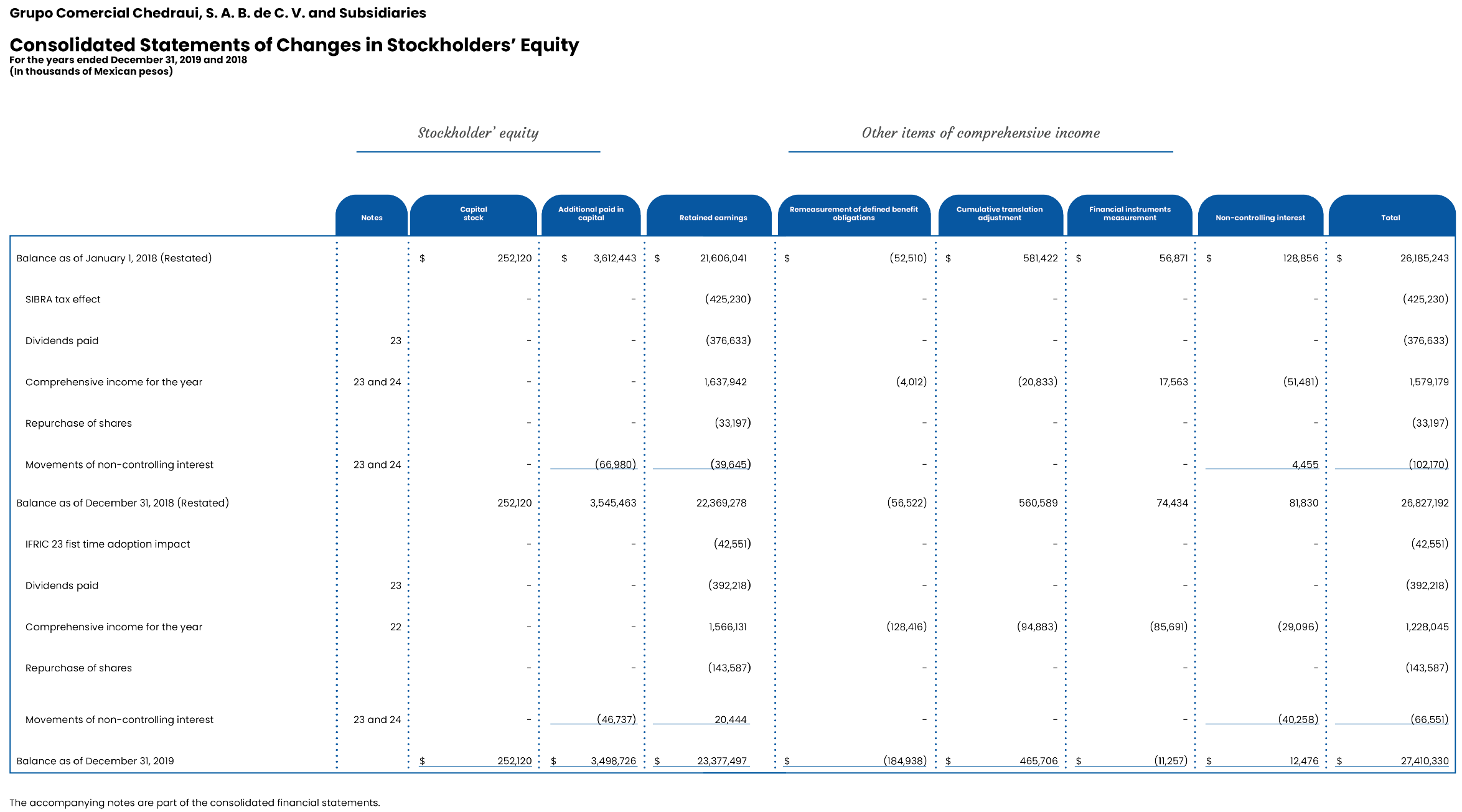

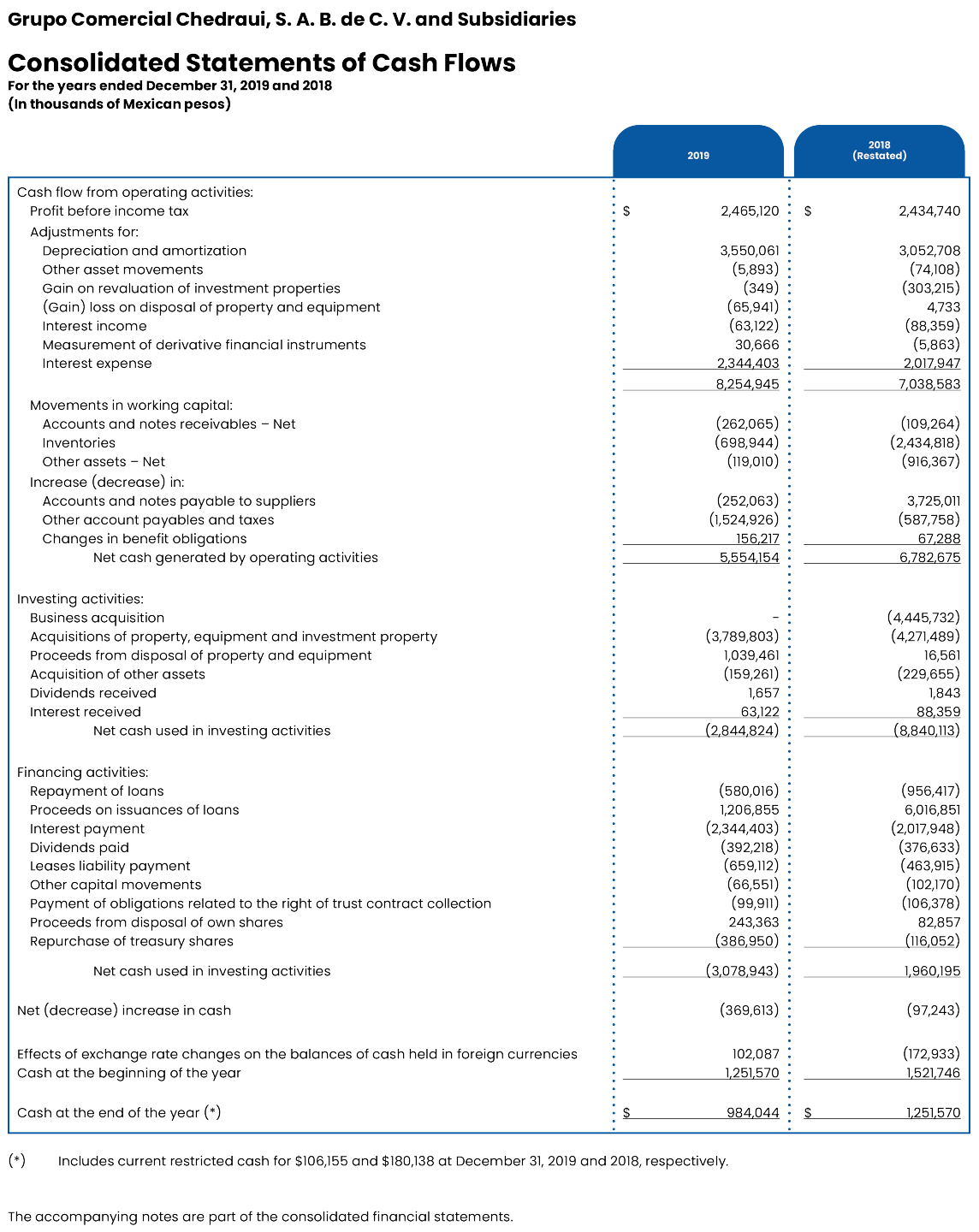

We have audited the consolidated financial statements of Grupo Comercial Chedraui, S. A. B. de C. V. and Subsidiaries

(the Entity) which include the consolidated statements of financial position as of December 31, 2019 and 2018 and as of

January 1, 2018, the related consolidated statements of profit or loss and other comprehensive income, changes in

stockholders’ equity and cash flows for the years then ended December 31, 2019 and 2018, as well as the explanatory

notes to the consolidated financial statements, which include a summary of the significant accounting policies applied.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Entity as of December 31, 2019 and 2018, as well as their financial performance and their cash flows for the years then ended, in conformity with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

Bases for the opinion

We have performed our audits in conformity with International Auditing Standards (IAS). Our responsibilities under

these standards are explained more extensively in the section Auditors’ responsibilities in relation to the audit of

the consolidated financial statements of our report. We are independent from the Entity in conformity with the Code

of Ethics of the International Ethics Standards Board for Accountants (IESBA Code of Ethics) and that issued by the

Mexican Institute of Public Accountants (IMCP Code of Ethics), and we have complied with the other ethical

responsibilities in conformity with the IESBA Code of Ethics and the IMCP Code of Ethics. We believe that the

audit evidence obtained provides a sufficient and adequate basis for our opinion.

Key audit matters

The key audit matters are those matters which, in our professional judgment, have been most important in our audit

of the consolidated financial statements for the current period. These matters have been dealt with in the context of

our audit of the consolidated financial statements taken as a whole and in the formation of our opinion on the latter,

and we do not issue a separate opinion on these matters. We have determined that the matters described below are the

key audit matters which should be communicated in our report.

Investment properties

To determine the fair value of the investment properties in accordance with International Accounting Standard 40

(“IAS 40”), certain judgments were used by management. There is a risk that the determination of the assumptions used

by management to calculate future cash flows may not be reasonable based on current and future foreseeable conditions.

Our audit procedures to cover this risk included the following:

Controls and substantive testing over the financial projections that were used to determine the fair value of the investment

properties, for which we ascertained the reasonability of the revenues and expenses used to determine the discounted

future cash flows, also, we ascertained the arithmetical accuracy of the projections,

and evaluated the assumptions used by the Entity to determine them, and confirmed, based on our knowledge

of the Entity and the audited historical information, that any nonrecurring effect will be normalized so that such

effects will not be considered in the financial projections. Additionally, we evaluated the reasonableness

of the discount rate used, for which purpose we consulted with our financial advisory specialists. The results of our audit procedures were

reasonable.

Notes 3 and 11 to the consolidated financial statements include the Entity’s disclosures regarding investment properties.

Impairment of long-lived assets

The Entity has identified that the minimum cash generating units are the stores, for which an analysis is made

as established in International Auditing Standard 36 (“IAS 36”), in which discounted future cash flows are

calculated to determine if the value of the assets has been impaired and whether it is necessary to have appraisals

conducted by an independent expert. There is a risk that the determination of the assumptions used by management

to calculate future cash flows, as well as the appraisal value determined by the independent expert, may not be

reasonable based on current and future foreseeable conditions.

Our audit procedures to hedge the risk in relation to the impairment of long-lived assets included:

Controls and substantive testing where we detail tested the projected income and expenses, and based on discounted cash

flows; we further verified, based on our knowledge of the Entity and the audited historical information, that any

nonrecurring effect will be normalized in the financial projections. We also evaluated the reasonableness of the

discount rate used, for which purpose we consulted with our financial advisory specialists. The results of our audit

procedures were reasonable.

IFRS 16 Leases

The Entity adopted for the first time as of January 1, 2018, IFRS 16 Leases (issued by the IASB in January 2016),

which establishes new or modified requirements regarding lease accounting. It introduces significant changes to the

lessee’s accounting, eliminating the distinction between an operating and financial lease and requiring the recognition

of a right of use asset and a lease liability for leases on the commencement date of all leases, except those that are

considered short-term or low value assets. In contrast to the lessee’s accounting, the requirements for the lessor

remain significantly unchanged. The details for the new requirements are described in note 3. The initial application

of the IFRS 16 was made using the retrospective method, that is, as if this new standard had always been applied,

therefore the Entity restated the comparative consolidated financial statements as of December 31, 2018 and for the year

then ended, as well as the consolidated statement of financial position as of January 1, 2018. The initial impact

of the adoption, as of January 1, 2018, of IFRS 16 in the Entity’s consolidated financial statements was to recognize

right of use assets for $12,611,418 and lease liabilities for $14,978,066.

Our audit procedures to cover the risk in relation to the initial application of IFRS 16 included the following:

We identify the internal controls that the Entity implemented to ensure the completeness and valuation of the leases

liability and the rights-of-use asset. We test the design and implementation of these controls and when we consider

it applicable, we test their operating effectiveness.

We performed substantive tests that included testing the reasonableness of the assumptions used to determine the value of

the right-of-use assets, as well as the balance of the IFRS 16 lease liability (completeness of contracts, amount of

future income, lease terms, etc.), we tested with the help of our Financial Valuation specialists, the reasonableness

of the mechanics used to determine the discount rate used according to the requirements of IFRS 16. We verified the

arithmetic accuracy of the calculations made by the management.

Our procedures included testing the reasonableness of the disclosures made by the Entity as included in Note 10.

The results of our audit procedures were reasonable.

Other Matter

The accompanying consolidated financial statements have been translated into English for the convenience of readers.

Information other than the Financial Statements and Auditor’s Report

Management is responsible for the other information. The other information comprises two documents, the Entity's Annual Report

and the information that will be incorporated in the Annual Report which the Entity is required to prepare in accordance with

article 33Ib) of the fourth title, first chapter of the General Provisions Applicable to Issuers of Securities and Other Participants

in the Securities Market in Mexico (the requirements). As of the date of our auditor’s report we have not yet obtained these documents

and they will be available only after the issuance of this Audit Report.

Our opinion of the consolidated financial statements does not cover the other information and we do not express any form of security about it.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so,

consider whether if the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained

during the audit or otherwise appears to be materially misstated. When we read the Annual Report we will issue the auditors’ legend about the

reading thereof, required in Article 33 Fraction I, subsection b) numeral 1.2. of the Provisions or if we conclude that it is materially

misstated we would be required to report this fact.

Responsibilities of Management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and reasonable presentation of the accompanying consolidated financial statements

in conformity with the IFRS, and for any internal control that management believes necessary to enable the preparation of the

consolidated financial statements free from material misstatement due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Entity’s ability to continue as a

going concern,

disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management

either intends to liquidate the Entity or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Entity’s financial reporting process.

Auditor’s responsibilities in relation to the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs

will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered

material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users

taken on the basis of these consolidated financial statements.

As part of an audit in accordance with IASs, we exercise professional judgment and maintain professional

skepticism throughout the audit. We also:

- Identify and evaluate the risks of material misstatements in the consolidated financial statements, due to fraud or

error, by designing and applying audit procedures which respond to these risks, and by obtaining audit evidence which

is sufficient and appropriate to provide the basis for our opinion. The risk of not detecting material misstatements

resulting from fraud is greater than those resulting from an error, because fraud may involve collusion, forgery,

deliberate omissions, intentionally erroneous declarations or the evasion of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures

that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness

of the Company's internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and

related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based

on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may

cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material

uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in

the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are

based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions

may cause the Company to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the financial statements, including the

disclosures, and whether the financial statements represent the underlying transactions and events in a

manner that achieves fair presentation.

- We obtained sufficient and adequate audit evidence related to the financial information of the entities

and business activities which comprise the Entity in order to express an opinion on the consolidated financial

statements. We are responsible for the direction, supervision and performance of the audit of the entities

comprising the Entity. We are the only persons responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of

the audit and significant audit findings, including any significant deficiencies in internal control that we identify

during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements

regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought

to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance

in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters

in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances,

we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be

expected to outweigh the public interest benefits of such communication.

Galaz, Yamazaki, Ruiz Urquiza, S. C.

Member of Deloitte Touche Tohmatsu Limited

C. P. C. Erick J. Calvillo Rello

Mexico City, March 11, 2020

CORPORATE HEADQUARTERS :

MEXICO HEADQUARTERS

Avenida Constituyentes 1150

Colonia Lomas Altas

11950 Mexico City, Mexico

Phone +52 (55) 1103 8000

XALAPA HEADQUARTERS

Privada Antonio Chedraui Caram 248

Colonia Encinal

91180 Xalapa, Veracruz

Phone +52 (228) 842 1100

STOCK EXCHANGE

Mexican Stock Exchange (BMV):

ticker CHDRAUI

AUDITOR

Galaz Yamazaki, Ruiz Urquiza, S.C.

(Deloitte Touche Tohmatsu)

INVESTOR RELATIONS

Jesus Arturo Velazquez Diaz

Head of Investor Relations

Phone +52 (228) 842 1117

avelazquez@chedraui.com.mx

This annual report may contain future projections about Grupo Comercial Chedraui S.A.B. de C.V. and its

subsidiaries based on assumptions made in good faith by management. Such information, as well as any

statements about future events and expectations, are subject to risks and uncertainties as well as factors

that could cause the results, performance or profits of the company to be completely different at any time in

the future. Such factors include changes in general economic conditions, domestic and international governmental

and/or business policies as well as changes in interest rates, inflation and volatility in foreign exchange rates, etc.

Because of these risks and factors, actual results could vary materially from the estimates presented in this document.

Grupo Comercial Chedraui, S.A.B. de C.V. does not accept responsibility for any such changes.